What To Expect This Fall

Experts Project Mortgage Rates Will Stabilize

While mortgage rates continue to fluctuate due to ongoing inflationary pressures and economic uncertainty, experts project they’ll start to stabilize in the months ahead. According to the latest projections, mortgage rates are expected to hover in the low to mid 5% range initially, and then potentially dip into the high 4% range by later next year (see chart to the right):

This should bring you some welcome relief! So far this year, mortgage rates have climbed over two percentage points due to the Federal Reserve’s response to inflation, and that’s made it more expensive to buy a home. But now that experts say mortgage rates should stabilize, this gives you a bit more certainty about what they think the future holds, and that may help you feel more confident about your decision to buy a home.

Oh - em - gee. The market is shifting. Yes, again.

It’s still a great time to be a seller in Denver and an amazing time to be a buyer. We’re past Labor Day. Typically we see the highest amount of inventory on the market in September, with a steady drop off for the rest of the year. Many sellers choose to list or re-list their homes next spring instead. There are only 4 full months left in the year, though, for buyers who are motivated to move. I’m ready to help you!

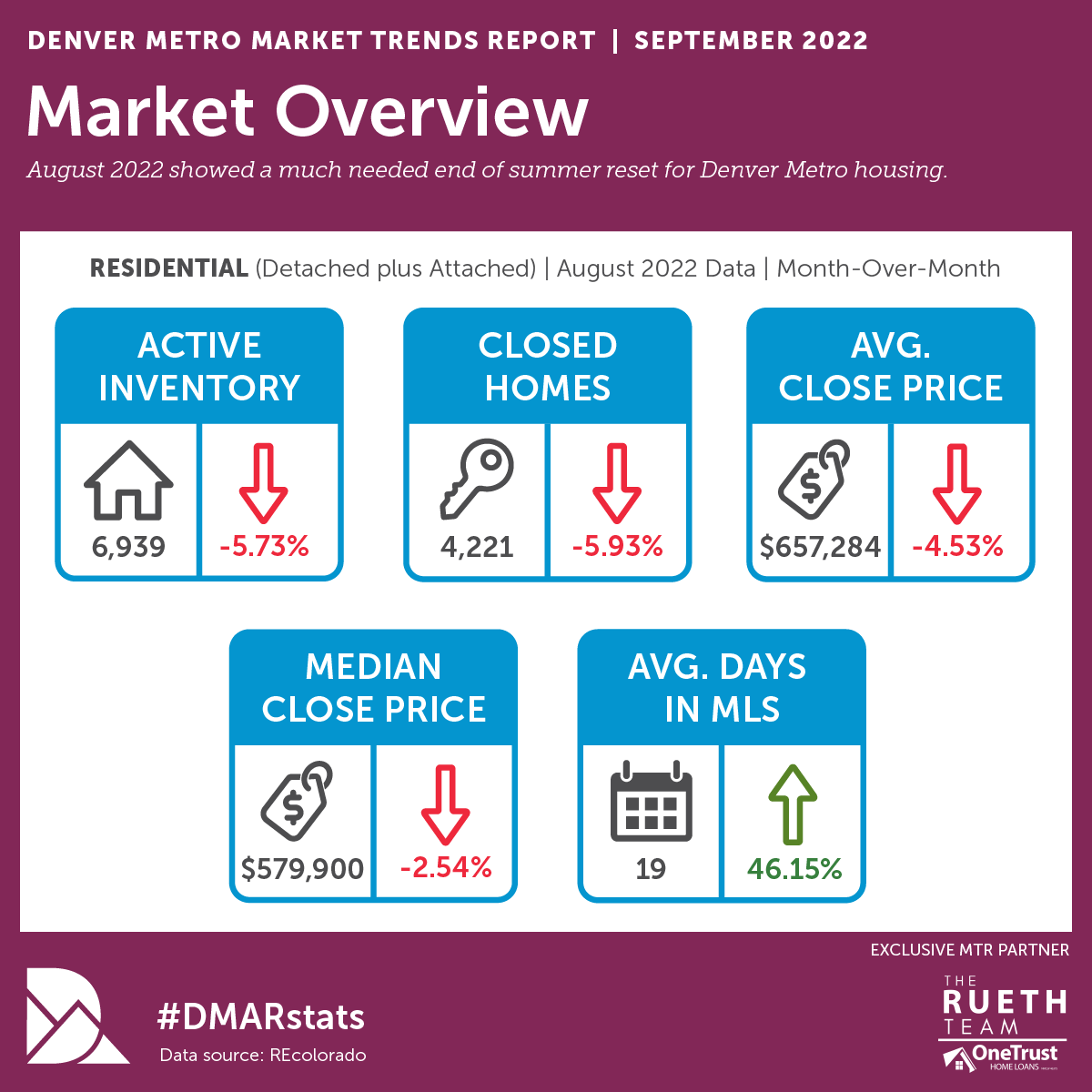

Take a look at the August month-over-month data from the Denver Metro Association of Realtors (DMAR).

Sellers:

Active inventory is down in August. It’s still a great time to list, and we are nowhere near a balanced market. Buyers are still out looking for homes, they just have a few more options than 6 months ago. And because of that…

Gone are first weekend offers and bidding wars. Plan for 19 days in the MLS on average, up nearly 50% from July. Plan on 12 showings before you get an offer.

If you price right, perfect your home before listing, and work with an amazing realtor (hi), your home could sell faster. There are still many deals closing

The average closed price is also down almost 5% and the median close price is down nearly 3%! You have to price right, and your comps need to be recent. If they aren’t from the last few weeks, you should plan to adjust the asking price to nearly 7% lower than earlier this year.

Buyers:

Yes, interest rates are higher than they were last year. But you have negotiating power right now that we haven’t seen in multiple years! Full inspections, no appraisal gaps, offers accepted at the asking price, and no bidding wars! You can always refinance interest rates when they go down, and they WILL go down. The beauty of the market is that it’s always changing.

You’re always paying 100% interest on rent. Rents are increasing like crazy all around the metro area.

Don’t wait for the market to crash. It won’t happen. Home values are still increasing overall and your equity gain in the years to come will outweigh those interest rates in no time.